April Summary

Ugghh…I feel like these past few months, writing these summaries has been such a drag! It always stinks when things don’t go the way you planned, but alas, this blog is to keep us accountable, so here we go!

April Analysis: The Good

So if you look at the table, there’s really not much good that jumps out, almost every column is a big fat red! However, I’m an eternal optimist and the good is that I turned 30 and my son turned 3 on the same day! Annd we had some amazing celebrations that were focused on experiences – an amazing trip to the zoo where the kiddo got to ride a pony, feed some goats, and go on a “safari,” a fantastic dinner at a local Thai restaurant (the kiddo’s choie) with my in-laws, fun and frugal birthday celebrations at our home with friends and family, a trip to the circus, and a very fun adults night out for dinner with my awesome friends to celebrate the big 3-0. Our family also got some very exciting news that was the perfect end to the perfect b-day celebrations!

From a financial perspective, we took some strides in developing a sinking fund. We hadn’t had one in the past and just paid our quarterly/yearly expenses (like HOA, water, property taxes) out of our monthly budget whenever they were due. We hadn’t run into issues doing this in the past, but I felt like it wasn’t really working as well as we’d like, so this month, I put money in our sinking fund right away. For April, this meant $150 for property taxes (that will be due in September/October), $95 toward our quarterly HOA fee, and $33 toward our quarterly water bill. I also put the $416 we were paying on hubby’s SL and put it in our savings account. We just refinanced my SL and those do not go into repayment until July. Also a plus for us – the kiddo’s daycare dropped by almost $400.

April Analysis: The Bad

Optimism aside, our numbers took a HUGE hit in April. We had planned to put an addition $1500+ towards debt this month and put absolutely nothing towards it. Plus, with a $400 drop in daycare, I was hoping that we’d get a huge chunk put towards either savings or dept repayment. However, that was not the case, and life kinda got in the way a little! Our HOA is really strict (plus: they are strict on everyone so home values stay up; minus: they are strict on us and it costs us money), and we had to do some repairs to the exterior of our home – most notably, we had to redo the ENTIRE landscape in our front yard b/c the landscaping timbers were rotted. Now, hubby did all of this himself over spring break and also fixed our pavers and built a garden, but it still cost us about $850 for all the supplies.

In addition to unexpected landscaping we also had the expected cost of birthday celebrations/easter and we stayed around what we planned to for those costs. We went a little over on my birthday dinner with friends and on our family birthday dinner and we went WAAY over on groceries (about $150 more than we expected given the anticipated extra expenses of hosting parties, and about $400 over our normal budget!)

Other expenses that were incurred in April included summer clothes for me and some shorts for hubby, as well as a wedding present for my brother and sister-in-law, hubby’s groomsman suit/alternations for the wedding, and our tickets for Gold Cup this weekend (amazing deal that will end up saving us $40). Some of this spending had been budgeted for May, so I took the money to cover the expenses out of May as well (they show up in our April charges, but I added in their equivalent dollar amount as other income).

April Analysis: Summary

All said and done we had budgeted around $725 in May for some of the expenses we incurred in April. We also had a childcare reimbursement for $1250 that helped make up a substantial part of the shortfall – not how I wanted to use the money, but glad we didn’t have to dip into our savings and that we were able to break even, in a very high spending month.

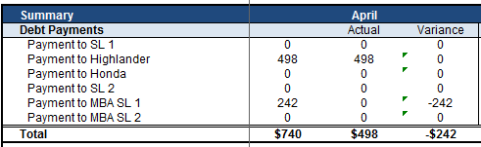

April Debt Repayment Summary

As you can see – not much progress. We didn’t pay anything toward my student loan because my consolidation/refinancing was still pending (the original loan servicer had been paid off, but the new bank had not processed all the paperwork). Because my loans are in the grace period after graduation, we’ll start making regular payments in July. Until then, we’ll take the amount we would have paid towards interest and put it in our savings account. When the first payment is due, we’ll use that accrued savings, plus our predetermined extra payment amount, to make a very large payment. It is very exciting to see that we currently only have one interest accruing loan left on our books (my student loans) – since the car is financed at 0%, we’re keeping with our normal payment schedule, and putting any surplus money we have in savings!

May Projections

In the interest of being more realistic, I actually adjusted May’s numbers based on what we actually expect to spend in each category, not on our basic budget amount. Since we’ve planned to put any surplus money into our savings until July, I’ve also bumped up the savings amount. Even in doing so, we still have a $125 buffer for anything unexpected that comes out, but by planning more carefully, I’m hoping we’ll find we limit the crazy overages we’ve had the past few months.

This month, we should see savings in our cell phone bill since we switched to our new, lower cost plan. We will also see savings in the kiddo’s daycare compared to previous months. However, we will also see a much bigger misc. fund due mostly to costs associated with my brother’s wedding. As I mentioned earlier, we’ve already incurred some of these costs (wedding gift) and I’m counting the cost as coming out of May from our bank account since that is essentially how we funded it (and, if you followed how i tracked it in April, it was basically a net zero expense that month since it was logged as an expense, but we also added income to cover the cost).

What all this means, is that, in addition to growing our sinking fund, we should also be able to add about $900 to our savings this month! That would make me VERY happy and I’m hoping that we’ll be able to stick with it. We do have lots of activities and expenses planned this month – my best friend’s 30th birthday, mother’s day, my graduation, and my brother’s wedding, but I think we’ve planned for all of them in our budget and hopefully, we planned right. I guess only time will tell!

How was April for you? Did you meet your goals? Face some challenges?